How much can one rail pass reshape an entire country’s economy? The Japan Rail Pass isn’t just a convenience for travelers — it’s a strategic catalyst that has influenced tourism patterns and regional development across Japan. Over the past decade, Japan Rail Pass statistics have underscored just how impactful it has become, shaping where tourists go, how they spend, and how long they stay. Originally launched in 1981 to encourage deeper exploration across the country — especially among international visitors — the pass offers unlimited travel on most JR‑operated trains, including the iconic Shinkansen bullet trains, for a set duration.

Operated collaboratively by six regional JR companies, the pass covers an expansive network that links major urban centers with lesser‑known towns and scenic regions — weaving together cultural, economic, and rural zones in a way few national rail systems can match. This connectivity has not only enabled convenience but also measurable economic influence, drawing tourist spending far beyond Tokyo and Osaka into areas poised for growth. Japan Rail Pass travel data highlights these shifts, revealing evolving spending behavior, more dispersed travel patterns, and the rise of emerging tourism hubs — trends that mirror broader post‑COVID inbound visitor growth tracked by the Japan National Tourism Organization (JNTO).

For insights on the broader context of travel and exploration in Japan, check out the MJ Journals hub for in‑depth narratives or start planning your next itinerary with the Adventure Starter guides.

Tourism Flow Enabled by the JR Pass

The JR Pass doesn’t just make travel easier—it actively reshapes where people go. By unlocking unlimited access to high-speed and regional trains, it encourages visitors to look beyond Tokyo and Kyoto and consider places they may have otherwise skipped. This isn’t just theoretical. Cities like Kyoto, Hiroshima, and Kanazawa have all seen a noticeable uptick in international tourists—not only because of their appeal, but because they’re effortlessly connected by Shinkansen routes covered by the pass. Easy access equals more foot traffic.

Even less expected spots like Takayama in Gifu or Aomori in Tohoku have grown in popularity, simply because they’re on the JR network. Once remote in the eyes of travelers, these destinations are now part of multi-city trips that would be too costly or complicated without the pass. It’s easy to stay powered on long travel days with essentials like the Anker Power Bank, 20,000mAh Travel Essential Portable Charger to keep your phone and maps alive, or plug in at hotels with a reliable OREI Japan, Philippines Travel Plug Adapter – USA Inputs – Type A when you land. Tourism flow data shows a strong JR Pass regional impact, especially in areas served by the Shinkansen. According to MLIT’s regional statistics, prefectures with bullet train stops consistently report higher foreign visitor numbers than neighboring areas without them. In short, the JR Pass doesn’t just connect places—it helps define Japan’s modern tourism map

Spending Patterns of JR Pass Users

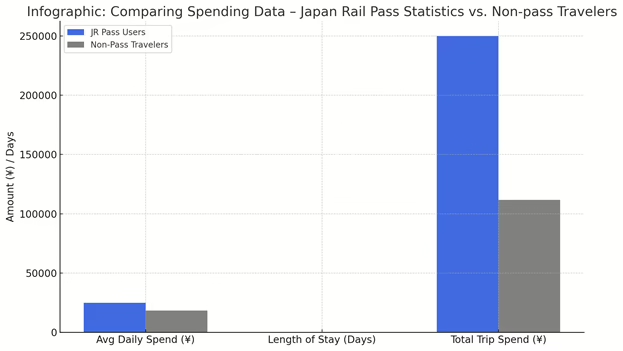

How much do JR Pass users actually spend—and where? The Japan Tourism Agency’s “Consumption Trend Survey for Foreigners Visiting Japan” reveals clear behavioral patterns: travelers using the JR Pass typically stay longer and spend more per day than those without it. This is largely because the pass encourages broader exploration and overnight stays in multiple regions, which leads to more spending on lodging, dining, and local experiences.

According to Japan Rail Pass statistics, average daily spending by pass users exceeds ¥17,000, compared to roughly ¥14,000 for non-pass tourists. The difference becomes even more apparent in regions like Tohoku, Kyushu, and Hokuriku, where JR-serviced areas show higher per-visitor revenues. In places like Kanazawa or Kumamoto, the increased tourist presence has translated into rising sales for ryokans, local restaurants, and souvenir shops.

The pass not only lowers travel friction—it multiplies spending opportunities. Travelers hop between regions that would otherwise be skipped due to time or cost. These patterns create ripple effects, helping smaller cities build tourism economies once concentrated in Tokyo and Kyoto. When aggregated, these micro-spending behaviors illustrate the real economic value driven by the JR Pass beyond just ticket sales.

Case Studies: Regional Economic Impact

To see the JR Pass’s real impact, it helps to look at the ground-level changes in the cities and towns it touches. These aren’t abstract stats—each destination tells its own story of revival, shaped by easier access and growing foot traffic.

Kanazawa (Ishikawa Prefecture)

When the Hokuriku Shinkansen connected Kanazawa to Tokyo in 2015, the effect was immediate. The city, known for its preserved samurai districts and gold-leaf crafts, saw international overnight stays surge by more than 40% in just two years. Local shop owners and ryokan hosts have spoken of the steady stream of visitors who would’ve never come without the convenience of the pass.

Rural Tohoku

In northern Tohoku, towns like Aomori and Akita began seeing new life after the launch of the JR East Welcome Rail Pass. It was a targeted effort to bring tourists into areas still recovering from the 2011 disaster. Seasonal festivals, local food experiences, and storytelling walks gained new attention as travelers ventured far from the typical routes.

Oita & Kyushu

Down in Kyushu, JR’s marketing efforts paid off. Cities like Oita and resort towns like Yufuin became hotspots for international tourists. Locals reported increased business in boutique inns and family-run restaurants. JETRO surveys confirmed what the community already felt: spending in the region was rising faster than the national average.

Each of these places reflects the broader JR Pass regional impact—not just by putting towns on the map, but by keeping them there through repeat visits, word-of-mouth buzz, and a more balanced flow of tourism across Japan.

Policy Perspective: Subsidies, Limits & Future Planning

While the JR Pass has been a powerful tool for regional tourism, recent policy shifts have raised questions about its future role. In October 2023, Japan Railways increased the price of the nationwide pass by nearly 70%, citing infrastructure costs and long-term sustainability. The hike sparked concern among tourism stakeholders, especially in rural areas that rely heavily on international foot traffic. The impact was immediate. Regional data suggests some travelers are now opting for shorter routes or regional passes, potentially limiting the economic reach that the full JR Pass once enabled. Analysts are closely reviewing Japan Rail Pass statistics from JR East and JR Central to track these evolving patterns.

Meanwhile, several local governments are actively pushing for expanded Shinkansen service to ensure their areas remain connected and competitive. Proposals like the Hokuriku extension to Tsuruga and upgrades in Hokkaido reflect this strategic interest in keeping regions on the rail map. Balancing affordability with access, and growth with sustainability, remains an ongoing challenge. The future of the JR Pass may depend on flexible solutions that evolve with traveler expectations and regional needs.

Data Visualization & Infographics: Japan Rail Pass Statistics

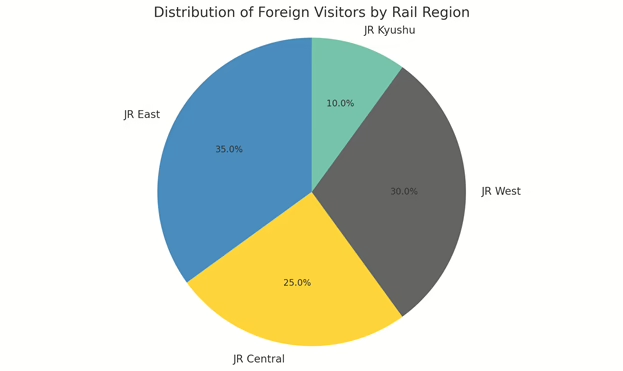

To truly understand how the JR Pass shapes regional economies, visual data helps connect the dots. Recent charts comparing JR Pass users to non-pass travelers show clear differences in daily spending, trip duration, and overall economic contribution. For example, pass holders not only stay longer but also tend to visit more regions—spreading their spending across a wider geographic area.

A timeline of Shinkansen expansions reveals a close link between new rail access and spikes in international arrivals. When the Hokuriku Shinkansen reached Kanazawa in 2015, tourism growth in the region followed almost immediately. The same trend appeared after the opening of the Kyushu and Nishi-Kyushu lines.

Visitor distribution maps further illustrate how travelers with rail access gravitate toward JR East, West, and Central zones, with growing traction in Kyushu. These patterns are more than statistical—they reflect how infrastructure shapes behavior.

By visualizing these trends, policymakers, local tourism boards, and businesses gain a clearer picture of where growth is happening—and where untapped potential may still exist.

Who’s Watching the Japan Rail Pass Statistics Trend?

The growing influence of the JR Pass hasn’t gone unnoticed. Think tanks studying the JR Pass regional impact consider this model key to equitable development, especially in countries looking to reduce urban overcrowding while revitalizing rural zones. Organizations focused on travel policy and sustainable infrastructure are tracking how the pass shapes mobility patterns and regional economies.

Urban planners and regional development groups see the JR model as a case study in balanced tourism growth — so much so that many travelers prepare with guidebooks like The Rough Guide to Japan to understand regional differences and local attractions before they even arrive. Meanwhile, rail tech firms and infrastructure investors are watching Japan closely, particularly in how public‑private partnerships can support long‑term profitability through tourism.

Globally, countries with underused rail networks are exploring similar models—hoping to replicate Japan’s blend of efficiency, access, and regional revival.

Japan Rail Pass Statistics and How They Reflect Regional Growth

The data tells a clear story. The JR Pass regional impact highlights how infrastructure can drive local recovery—not just by improving access, but by shifting spending, increasing visitor flow, and supporting small business ecosystems. From Kanazawa to Oita, regions once overlooked have seen renewed attention and economic lift, all linked by rail. At the same time, carefully tracking Japan Rail Pass statistics is essential for guiding future development plans. As prices change and usage patterns evolve, knowing how travelers move—and where they spend—can help policymakers and investors make better decisions.

Japan’s success with the JR Pass offers more than a tourism strategy. It presents a model for countries aiming to decentralize tourism, protect cultural assets, and build economic resilience through mobility. But this growth must remain sustainable. Overuse, pricing barriers, or uneven development could dilute the very benefits the system was designed to create. If managed wisely, the JR Pass isn’t just a ticket—it’s a blueprint for rail-led revitalization across the globe.